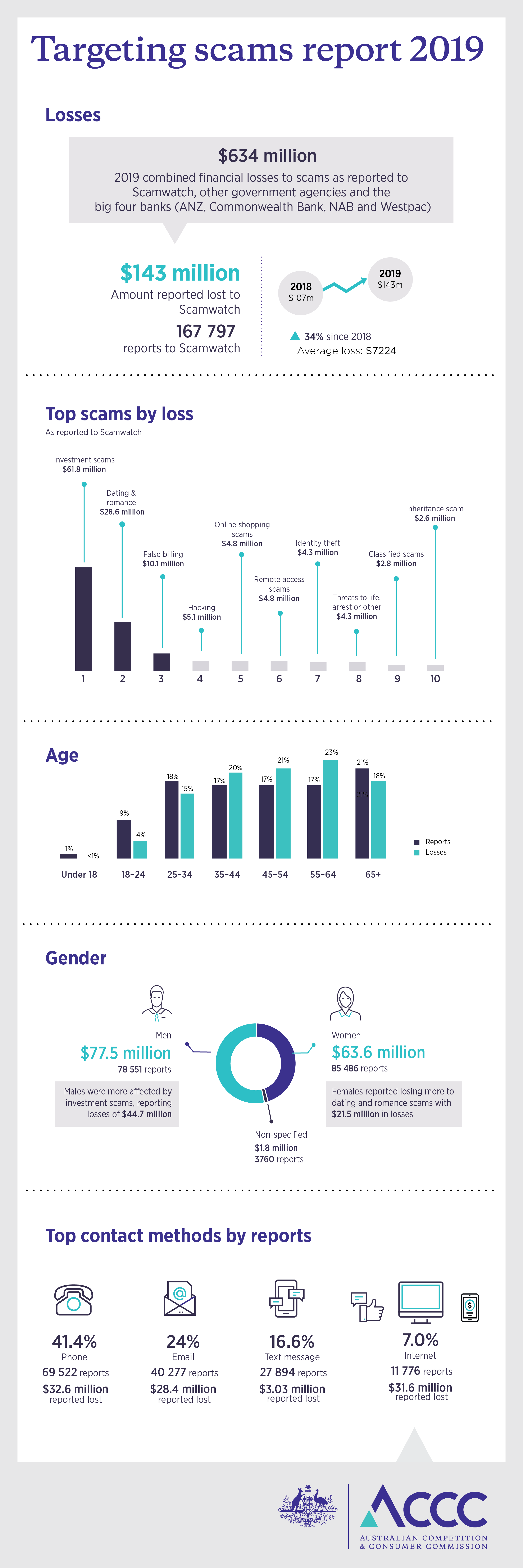

Australians lost over $634 million to scams in 2019, according to the latest figures in the ACCC’s Targeting Scams report released today.

There were more than 353,000 combined reports to Scamwatch, other government agencies and the big four banks last year.

“Unfortunately it is another year with devastatingly high losses, and scammers are constantly finding new ways to defraud Australians,” ACCC Deputy Chair Delia Rickard said.

“This year we have included data from the big four banks which gives a more complete picture of how much people are losing to scams.”

Business email compromise scams accounted for the highest losses in 2019, with the Australian business community, and some individuals losing $132 million.

This was followed by investment scams at $126 million, and dating and romance scams at $83 million.

Over the last 10 years of Targeting Scams reports, Scamwatch has received almost one million reports of scams.

“When we combine Scamwatch reports with partner data, we see that Australians have reported losing $2.5 billion over that time, which is astonishing,” Ms Rickard said.

“We know these numbers still vastly understate losses as around one third of people don’t report scam losses to anyone and in the past far fewer scam reports to other agencies have been captured.”

“Some of these scams can last for months, or even years, and can leave victims financially and emotionally devastated.”

Based solely on reports provided to the ACCC in 2019, scams originating on social media increased by 20 per cent and contacts via mobile phone apps increased by 29 per cent.

“Over the last decade, scammers have taken advantage of new technologies and current scams are using social media apps and new payment methods that didn’t exist in 2009,” Ms Rickard said.

“In particular, a new trend with dating and romance scams is scammers contacting the victim on social media apps or games which are not designed for dating, so it’s important to be aware that scammers can target you anywhere.”

Common techniques that scammers use to manipulate their victims include making exclusive offers that you don’t want to miss out on, or asking for small commitments, such as completing a survey, to make the victim more likely to comply with larger schemes.

“You can always say no, hang up the phone or delete an email, even if you’ve said yes previously. You don’t owe the scammer anything,” Ms Rickard said.

If you think have been the victim of a scam, contact your bank as soon as possible and contact the platform on which you were scammed.

The ACCC continues to work with the private sector to share intelligence about scam trends impacting their services, to assist their own disruption efforts.

The ACCC encourages people to visit www.scamwatch.gov.au to report scams and learn more about what to do if they are targeted by scammers.

They can also follow @scamwatch_gov on Twitter and subscribe to Scamwatch radar alerts to keep up to date with advice for avoiding the latest scams affecting the community.

Background

The 2019 Targeting Scams report includes data from Scamwatch, ACORN (ceased operating 30 Jun 2019), ReportCyber (commenced 1 Jul 2019), ACMA, ATO, Services Australia, WA Scamnet, Commonwealth Bank, NAB, Westpac and ANZ.